Online banking is most preferable, as we can able to pay from anywhere. If it is regular banking, we have to move to the bank even in order to transact, paying bills, etc.… in order to online banking, we can use features of a bank in any other places. Comparing to everyday banking, online banking is the most preferable and comfortable manner. This is the reason why people choose online banking. There are some more features in the bank, tangerine chequing accounbt log in

which is listed below.

Online banking has certain features; there typically are some of the capability, also have some specific application. The parts have many categories; they are

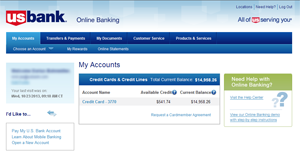

- To view the balances in the account.

- To view the recent transactions.

- To download the statement that is in pdf format.

- To maximize the image in cheques.

- Order check book

- Downloading the statement in account

- Applications like E-banking, M- banking, etc…

Tasks included in online banking to transact the money.

- The fund can be transferred between the linked account of a customer.

- Paying for third parties includes a payment, transferring a fund. For example, Gpay or FAST, etc…

- Investment in sale or purchase

- The transactions in loans and applications like as repay enrolments.

- Applications in credit card

- Utility in billings and making payments

- Institution in administration

- Users in multiple management vary with authority.

- Process in transaction approval.

Banking services

There is management support, like data importing into accounting and software as personal. It supports as a platform aggregates in customer allowance in all accounts in a bank or an institution.

Privacy or security

The information is essential to secure the passwords like the pin, etc… this is a risk in securing things with an authorized one. The authentication of a password should be in use. It should be banking in other countries. There are different methods in the security process of online banking,

PIN or a password is used to set for a security process for the process of login. The TAN represents a one-time password in authenticating the transactions. The TANs have been distributed differently. Tokens are used to generate in the form of 2FA, which is abbreviated as two-factor verification. Now there are more advantages in the chip model, which includes the data transactions. in case of discovering the middle attacks in man. The services like Photo TAN, the bank used to generate the QRcode of a device in a smartphone. There is no manner of encryption in an additional way. Signature is an essential thing in transactions. The signature is the key for generation and as well as encryption in smartphones. This is useful for people who use online banking. It can be stored in smartcards or memory medium, depends on the implementation in concrete, for example, Spanish ID card.

Attack

There are some of the banking, and they used to deceive the data while logging in and the TAN valid. We used to have two more examples in attacks they are pharming, phishing, trojan or keylogger, and scripting like cross-site can also be used to steal information which gets to login.

The signature attack is to manipulate in the way of software; the corrected transactions have been shown in faked and screen transactions which are said to be background signed.