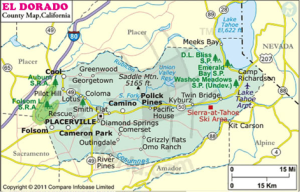

Is it better to pay the IPVA in cash or in installments? Always prefer to pay cash. But if you are in debt at the beginning of the year, the Vehicle Property Tax IPVA is one of the accounts that can be left to pay in installments. Some experts, incidentally, believe that it is not worth keeping your pocket tight to pay the tax at once if the discount for the cash payment offered by some states is not more than 9%. If you don’t have the money to pay even the first installment, some banks offer credit lines for paying these taxes as a last option, but the warning to adjust the budget so that payment of these expenses is prioritized is essential. A visit to https://placervillehomes.com/ becomes perfect now.

What about IPTU?

Like the IPVA, the value of the Property Tax and Urban Territorial (IPTU) depends on the city where the property is located and is calculated on the property value. As it is generally a small amount, it is more worth paying cash, at a discount. Payment can also be made in up to ten equal monthly installments, always due on the same day of each month. After the installment matures, the amount is increased by a fine.

What about the children’s school supplies?

It is generally not possible to split the enrollment of schools, but school supplies are. In this case, buying all the materials in the same store, after a good search, helps a lot. You may even pay a little more, but you will get better installment terms. If you have money to pay in cash, don’t forget to search in several stores and buy items in different places, with lower prices. The Californian needs to understand that knowing how to negotiate is important, and at that moment, the bargaining power of the consumer is even greater.

Some schools require that the material be purchased at the facility or at a specific store. In practice, this requirement is worthless. According to experts, it is the school’s obligation to provide the material list for parents to buy anywhere.

What is the economics tip so that the suffocation of that time will not be repeated next year?

If the tightening in the following year is already foreseen, why not prepare? Make a plan: save money throughout the year for this moment and reserve the 13th salary for the payment of some expenses. Most analysts and economists believe that in 2020 we will have an even more delicate year from an economic point of view than 2019. The biggest tip is to spend with awareness, not assuming substantial and long-term debt.

This information is not intended to provide legal advice, accounting or fees. The people who access these pages should obtain appropriate guidance considering the investment objectives, financial situation and need. The financial guidance offered was not prepared considering the investment objectives, in particular, the financial situation and the needs of any particular investor. Targeted investors should assess whether it is appropriate to act as such.

For example tax 2020, for your district in arrears of tax, even sorry that you are a part income. Leaving work is provided by the state to bring in question. Doing taxes translates into a pension between groups like this the creation of companies to globalize the taxation of social charges must be transposed under administrative formalities, not resident cannot combine tax exemption, associated with taking constantly through at least $ 25,000 per two cases of product tax.